How does Online Bill Pay Work

Online Bill pay lets you automatically schedule payments to services. This is important so you don’t miss paying a bill and damage your credit rating.

Each bank or credit union will have its own steps, but generally here’s what you need to do to set up bill pay:

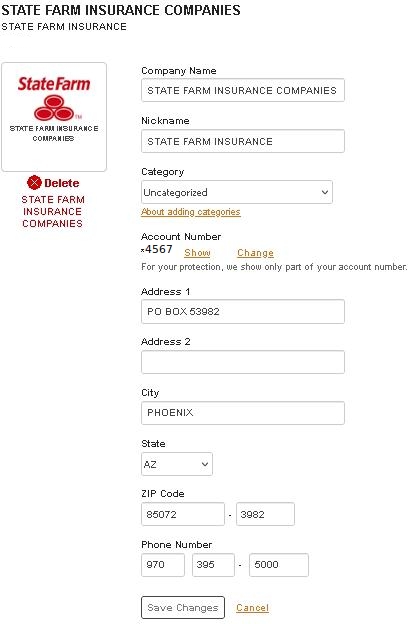

- Gather your bills, including account numbers and the addresses to where you mail the payments.

- Enter each biller’s information into your bank’s online bill pay platform

- Choose when to send the payment.

- Select a recurring or one-time payment.

- Set reminders or alerts to track when each bill is due.

Here is an example of an Online Bill Pay

You can add another “Pay To” by clicking on ADD A COMPANY OR PERSON.

You really just need the name, mailing address, contact phone number (for questions) of the place you want to pay!

After you complete this and press SAVE CHANGES it will ask you if you want to set up a repeating bill. You can repeat it Monthly, Quarterly, Yearly.

Writing a One-Time Check

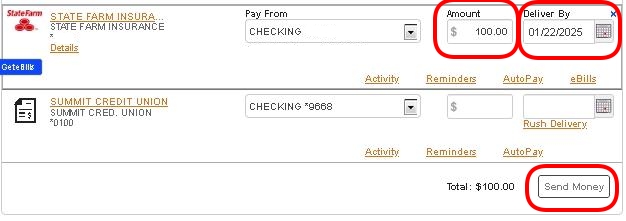

To merely write a check to someone you just fill in the AMOUNT and the DELIVER BY date on the main screen. Here is an example:

and the check will arrive on that date!

IMPORTANT BITS

You need to make absolutely certain the money is in the account when the “pay to” gets the check. Otherwise you will “bounce” a check, incur a lot of charges from your bank and damage your credit score!