RETIREMENT

When you are young most people can not see the value in planning for retirement as it seems to be a long way off. In fact, this is the best time to invest, since time will do most of the work for you!

Even if your employer has no retirement plan or 401k, YOU can do this yourself! Just visit a financial advisor at a place like Edward Jones, and tell him that you would like to setup your own Individual Retirement Account which is also called an IRA.

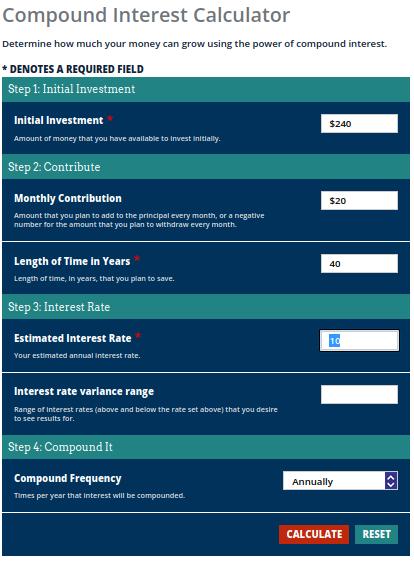

Here is an example of this:

Imagine that you are 25 years old and tell your bank’s online bill-pay to mail a $20 check each month to an IRA that you have at an Investment house like Edward Jones.

Let’s imagine you told your investment advisor that every time he gets that check he should buy shares of the stock index fund called SPY which represents the S&P 500 index that you hear about in the news every day.

After 12 months, you would have put $240 in that account.

Historically, the S&P 500 has averaged a yearly return 10.13% since 1957.

Now imagine you retire at 65 years old (40 years)

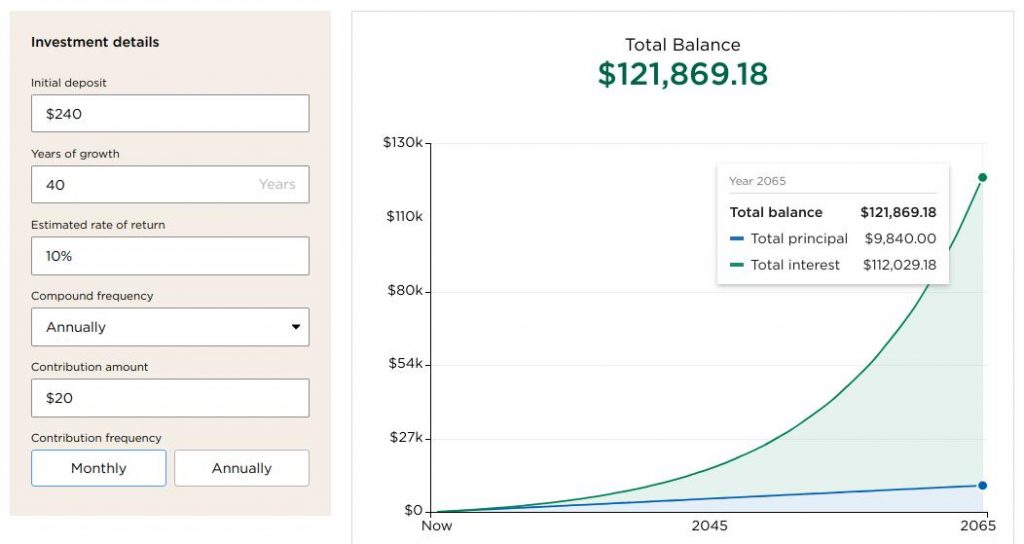

If you use a compound interest calculator like the one from Investor.com you would find that you would have a retirement nest egg of $121,869.18

Interesting because you would have spent $9,840 and earned an additional $112,029.18 for essentially doing nothing!

Once you start investing this way, you can re-evaluate that $20 and increase it as your budget improves and you have an even greater return.

Now imagine you are 65 years old, and you tell the Edward Jones rep to put this $112,029.18 into a Municipal Bond Fund paying 4%.

Municipal bonds are usually exempt from federal income taxes, and if bought in your state they may also be exempt from tax.

That means you will get $406.23 each month ($4874.76 each year) tax-free as retirement income for as long as you hold it.