Although you earn an amount per hour, or a yearly salary, you will NOT be paid that amount. A portion of every dollar you make will be taken and given to the Federal, and State government. You will see this on your pay check in the form of Payroll Taxes.

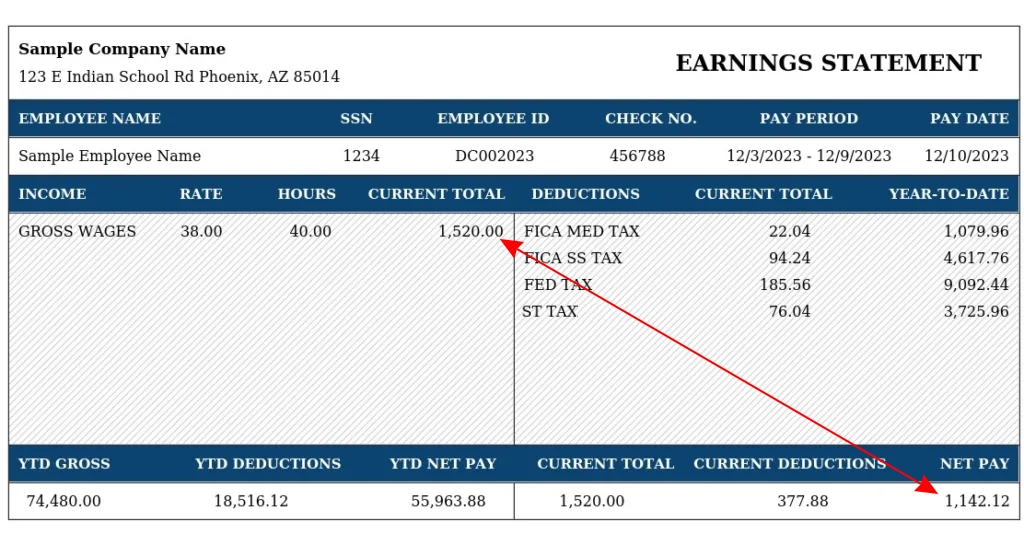

Here is an example of a “pay stub” showing the typical payroll taxes.

You can see that the amount you earned ($1520) is a a lot different than the actual amount you got paid ($1142.12).

This is because you are forced to give money to the federal and state government. You see those items on the right side of the pay stub. Here is what they mean:

FICA MED TAX

This is the money you are forced to pay for Medicare (old people healthcare) and MediCAID (poor people healthcare). You pay this for every dollar you earn.

FICA SS TAX

This is the money you are forced to pay for Social Security. This is a program that pays a tiny retirement income when you reach 62 years old. It also pays for Social Security Disabilty which gives money to people who have a disability that stops or limits their ability to work

FED TAX

This is the Federal Income tax you are forced to pay. The federal government forces your employer to take the money from you, and send it to them, as they believe you can not be trusted to pay it. The amount that is sent is controlled by how you filled out Form W4. This defines the amount of deductions, and any additional amount to withhold from each paycheck.

ST TAX

This is the State income tax that you are forced to pay. Like the Federal tax, the amount is controlled by how you filled out Form W4.