A W-4, or Employee’s Withholding Certificate, is an IRS form employees in the U.S. fill out to let their employer know how much federal income tax to withhold from an employee’s paycheck. Your employer sends the money it takes from your paycheck to the IRS, along with your name and Social Security number.

You typically fill out a W-4 at the start of a new job, but you can update it anytime your financial situation changes. The amount taken from your paycheck counts toward paying the annual income tax bill at the end of the year.

Accurately completing the W-4 ensures you won’t owe a large amount at tax time or receive a large refund.

It has five sections to fill out including personal information, multiple jobs, dependents, and additional adjustment to withholding.

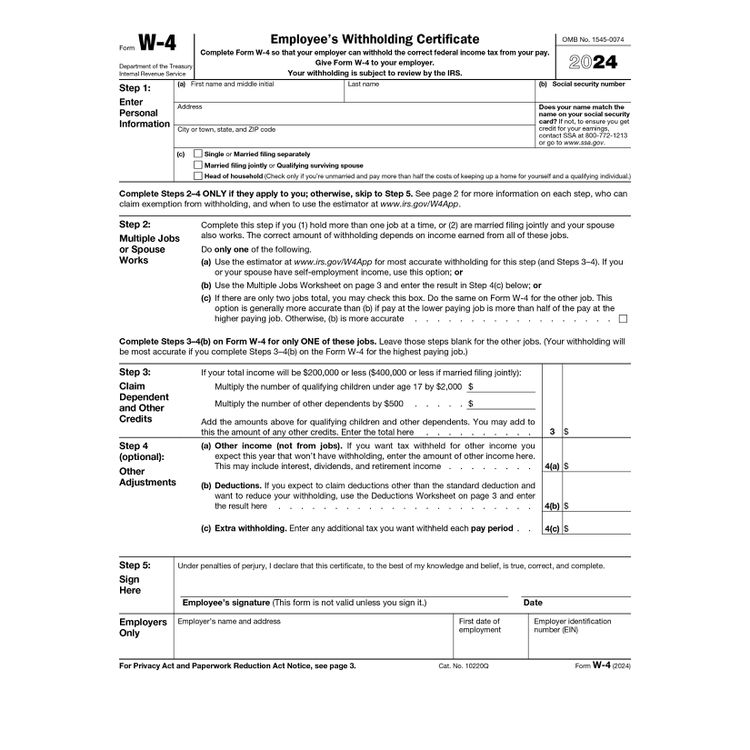

HOW TO FILL OUT FORM W4

Step 1: Provide Your Personal Information

Fill out your name, address, Social Security number, and filing status single, married or head of household (when you are single with a dependent child).

Step 2: Specify Multiple Jobs or a Working Spouse (only if you have more than one job)

Step 3: Claim Dependents (only if you have any)

Step 4: Make Additional Adjustments

In this optional section, you can withhold more or less from your paycheck.