CARS

Getting back and forth to work and other places is easier when you use a car. Before you even consider buying a car you need to get a few things in order.

CAR INSURANCE

Before you shop for a car, make sure you can afford the insurance. In Wisconsin, vehicle owners are required to have liability insurance.

Don’t drive without car insurance. It is illegal and one accident can completely ruin your life.

Minimum liability coverage is $25,000 for injury or death of one person, $50,000 for injury or death of two or more people and $10,000 for property damage. Insurance company’s represents that like this: 25/50/10.

COVERAGE TYPES GREEN-REQUIRED IN WI

Collision coverage

Helps pay for repairs or replacement of your vehicle if you’re in an accident with another vehicle

Comprehensive coverage

Covers losses from things like fire, wind, hail, and vandalism

Liability coverage

Compensates others for injuries and property damage if you’re at fault in an accident

Medical payments coverage

Covers medical expenses, funeral costs, and health insurance deductibles for you and your passengers, regardless of who caused the accident

Personal injury protection

Covers medical bills, lost wages, and other financial losses for you and your passengers, regardless of who caused the accident

Property damage liability coverage

Covers damage you cause to other people’s property or objects with your car

Uninsured motorist coverage

Pays for medical bills and property damage if you’re hit by an uninsured or underinsured driver

PICKING AN AGENT

Contact an agent and tell them you would like to price car insurance because you would like to buy a car. They will be happy to help you at no charge. There are four types of agent models that can sell you insurance:

- independent agents.

An independent insurance agent is a licensed insurance professional who sells insurance policies from multiple insurance companies. They are not employed by any one insurance company, - Direct writers whose agents are company employees.

A direct insurance writer is an insurance company or agent that sells insurance policies for a single insurance brand. They are also known as captive agents. Examples of these include State Farm, American Family - Online writers where you can get quotes and order policies online.

An online insurance writer, also known as an online insurance agent, is a professional who sells insurance policies to customers through the internet. Examples of these are like Geico and Progressive - Wisconsin Automobile Insurance Plan (WAIP).

Only available to people who can not get insurance anywhere else. This is a Wisconsin Government Agency.

The choice of who you use will vary based on price, and how responsive they are in processing claims.

Independent agents can shop many different companies and get you the lowest insurance rate. Those companies may or may not be as responsive as the companies represented by direct writers.

Direct writers are often more responsive as they are direct employees of the insurance company and can actually process the claim without an intermediary.

Online writers are frequently cheaper, but since they lack a physical local contact, they can often be unresponsive in processing claims.

How Insurance is priced

Insurance is priced to handle varying amounts of risk to the company. People who are more likely to have insurance claims will have rates that are higher. These are people like:

- People who drive a lot of miles

- Young inexperienced drivers

- Sports Car drivers

- Drivers who have accidents

- Unmarried drivers

- Poor Academic Students

- Smokers

- Discount for good student, bundling, Nonsmokers, Accident/claim free, yearly mileage

How to Lower Your Rate

There are 3 common ways to reduce your insurance cost that are within your control

- Reduce Coverage Types

- Only Liability, Injury and Property Damage are required.

- Reduce your liability levels

- Bad Idea:Although the law only requires 25/50/10, if you get in an accident, a law suit from it will easily take everything that you own. 100/300/100 are more typical protection limits.

- Reduce Miles Traveled Each Year

- Report Odometer readings yearly

- Increase Deductibles

- Finance High Deductibles with a unused no-fee Credit Card that you use only in an accident.

PICKING A CAR MODEL

1. Reliability

When you are starting out, life is hard enough without adding things like car problems. A good start towards finding the reliable car is just asking Google…. use the criteria what is the most reliable car. In 2024, Subaru was the most reliable car brand according to Consumer Reports. Pick a particular model so you can figure out what kind of problems to expect. Of Subaru’s seven models in Consumer Reports survey, two—the Forester and Impreza—have well-above-average reliability scores. We will pick Subaru Impreza because it has better fuel mileage.

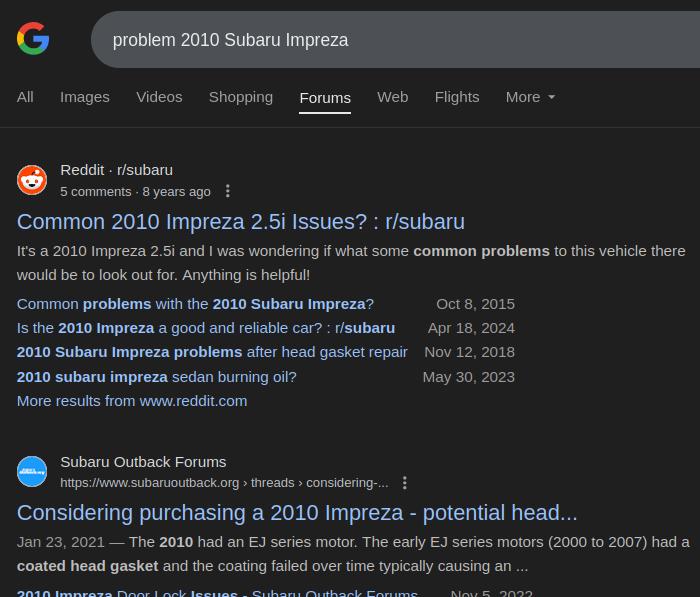

2. Problems to Expect

This is pretty easy also. Look for problems with the 15 year old model year. You need to go this old when you are first starting out. So in the year 2025, we would search Google for problem 2010 Suburu Impreza. when the search results come up, look for the web pages that are from discussion forums like this:

Read each of the problems. Make notes of how many times you see a specific problem occur. You will use this knowledge to evaluate a car when you purchase it.

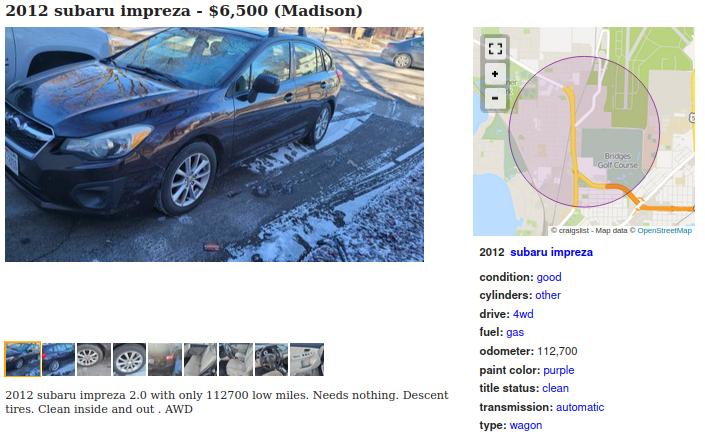

3. Finding the Car

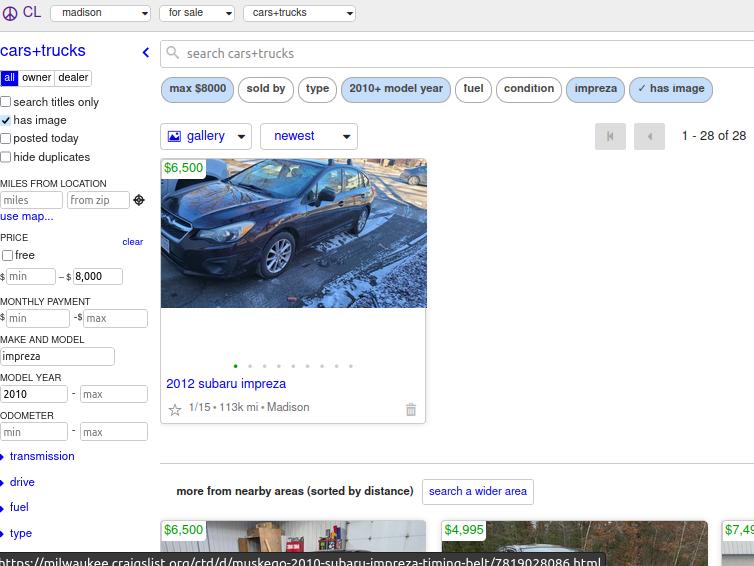

Use tools like Facebook Market Place, Craigslist and local car dealer lots are the places to try and locate the car. Here is what Craigslist did….

The important thing to remember when review these is that there are scammers out there. If it seems too good to be true, it probably is a scam. You will pretty quickly see what the normal price is going to be for the car you are looking for.

If the cars all seem to be $4000 – $5000 and you see an ad for a $2000 car that looks perfect…its probably a fake. Move on to the next car.

4. Examining the Car

This is the harder part. It is not uncommon for a seller to fail to tell you about all the things wrong with the car. YOU will need to find them. Print out this Car Inspection Page before you go examine the car.

5. Completing the Sale

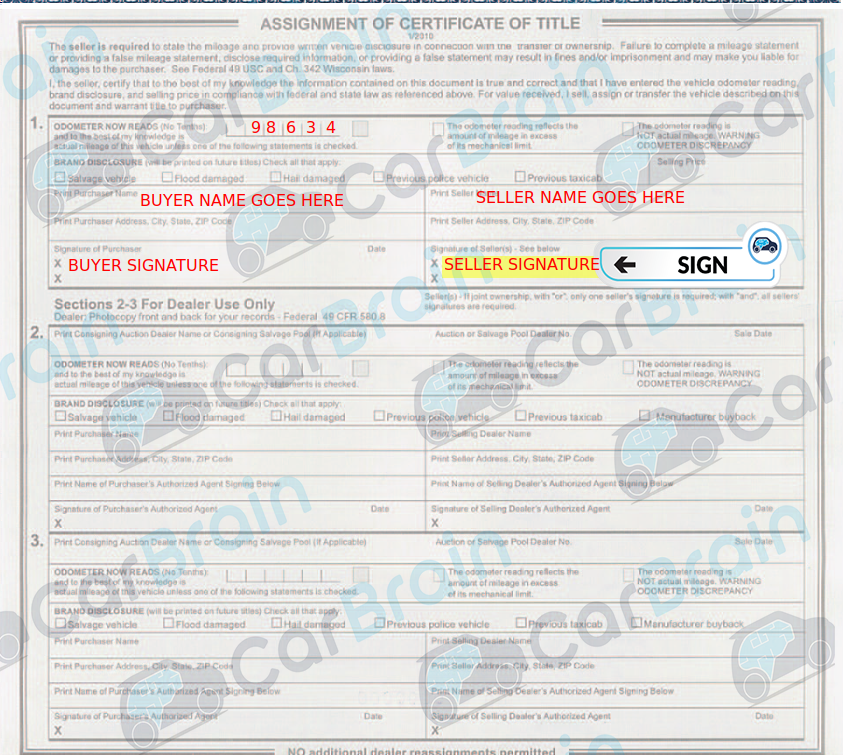

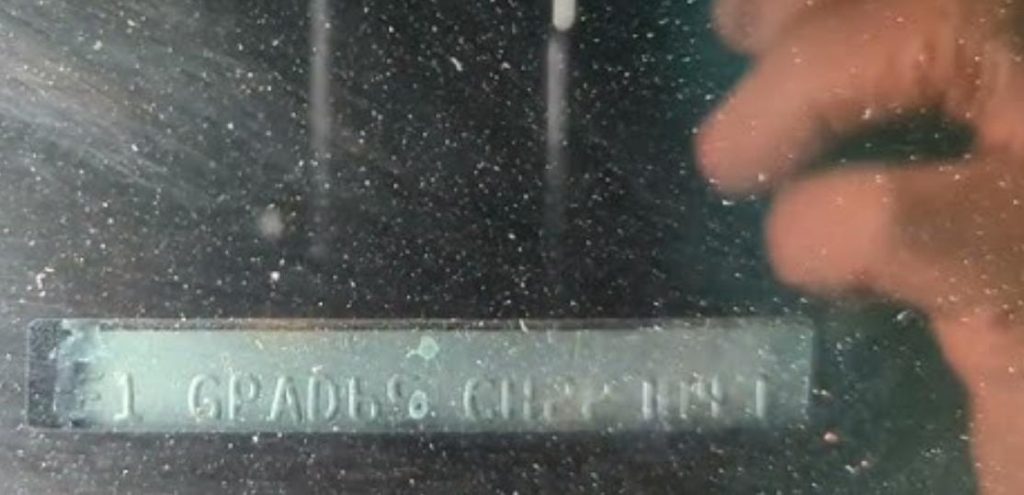

To complete the sale the seller will bring out the car title. The important part you will need to confirm is that the vehicle ID number (VIN) matches the number on the title. You will find the car’s actual VIN inside the windshield or the drivers side door pillar. Here is what it looks like on the windshield.

You will match this number with the car title to make sure you are legally getting what you are paying for. It is on the upper left corner of the car title.

on the back of the title the seller will print his name and sign it in the spaces you can see above. You or him will need to record the mileage and the amount of money you paid for this. The Department of Motor Vehicles will use this sales price to charge you sales tax. You might be tempted to lie about this amount, but the DMV has been know to contact the seller and confirm that the amount is accurate.

REGISTERING THE VEHICLE WITH THE DMV

Now that you have the title, you can go to the DMV office with the title and they will have a form for you to fill out. You will need:

- The original title

- Driver’s license

- Sales tax on your purchase amount … the purchase price x ,055 = the money you need for sales tax

- Title fee: $164.50

- Passenger vehicle fee: $85

- Hybrid vehicle fee: $75

- Counter service fee: $5

for a total of $319.50 plus the sales tax.

You will take a ‘now being served’ ticket, wait until your number comes up, then you will walk up to the counter and the clerk will help you complete the process. When you complete it you will get:

1. A set of License Plates

2. A Car Title with your name on it

3. A pair of adhesive stickers you put on the license plates showing you paid for the registration.

You will have to pay this $85 fee each year you own the car.