CHECKING ACCOUNTS

A check account at a bank is used to make it easy for you to pay bills and store the money you earn for easy access later.

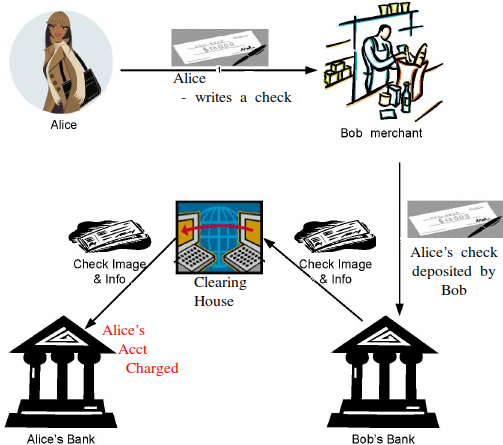

HOW DOES CHECKING WORK

When you write a Check or use a Debit card a series of events take place that cause the money to be taken from your account and be placed in someone else’s account.

This makes paying bills and getting money a lot easier than handling cash.

WHAT DOES A CHECKING ACCOUNT HAVE

A checking account has a few important components.

- Debit Card

- Check Book

- Check Book Register

DEBIT CARD

A debit card looks just like and functions just like a credit card but takes the money out of your checking account right away.

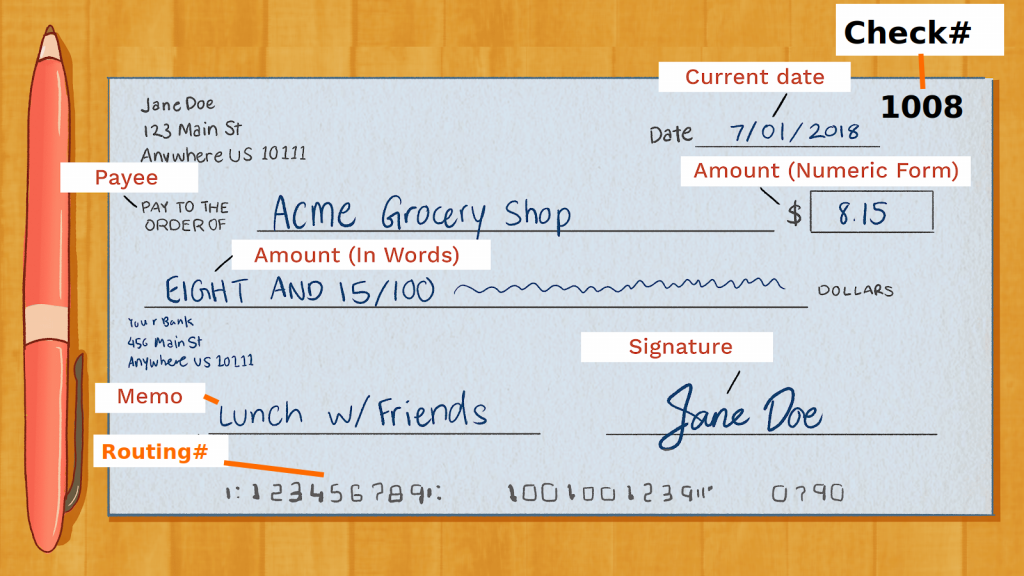

Check Book

The Checkbook contains blank check that you can fill out for someone you owe money to.

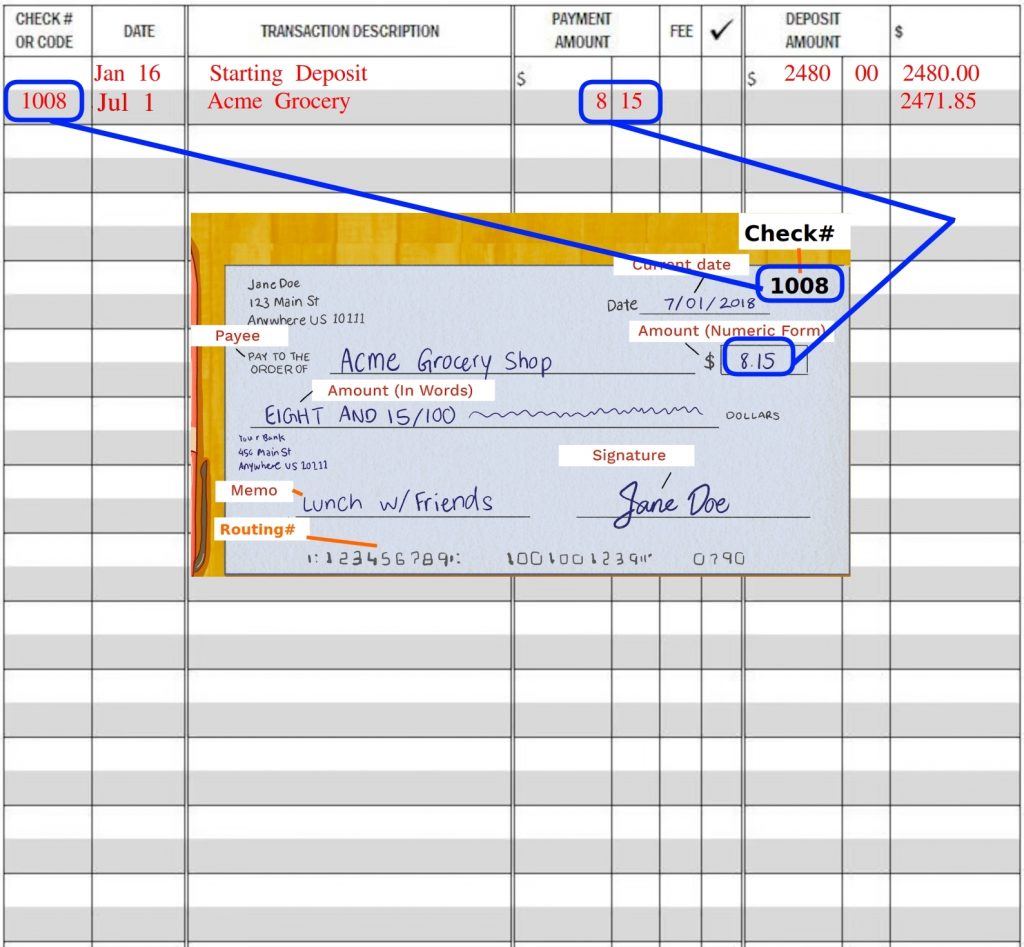

Here are the parts of a check and how you would fill them out.

- Check Number

Each of YOUR checks have a unique number to identify them to YOU. You will use this number when you record it in your check register. - Current Date

This is the date you wrote the check - Payee

This is the name of the person you are paying this money to… - Amount (numeric)

This is the amount of money (using numbers) - Amount (in words)

This the amount written using words. The dollars are written normally. 9 is written as Nine, 10 is written as Ten. The cents are written as though they are a fraction of a dollar. Twenty five cents looks like 25/100. Fifty nine cents would be 59/100. - Memo

The memo are is used to write note to yourself of why you wrote this check. Be sometimes the law has used things written in the memo field to decide court cases. A well known case is a check that was cashed were the memo said “Bill Paid In Full”. The court ruled that by cashing the check the payee said the bill was paid in full! Don’t try to be tricky with this though, as it could really backfire if you push it! - Signature

This is the signature that should resemble the signature card you signed when you setup the checking account.

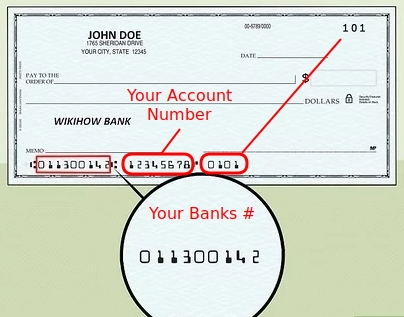

Routing Numbers

These numbers are called MICR numbers. They are not important when writing a check but useful to know how they work. They are magnetic characters so that automatic machines can read them.

There are three numbers from left to right. The first is the Bank’s routing number. The second is YOUR checking account number. The final number is the number of this particular check.

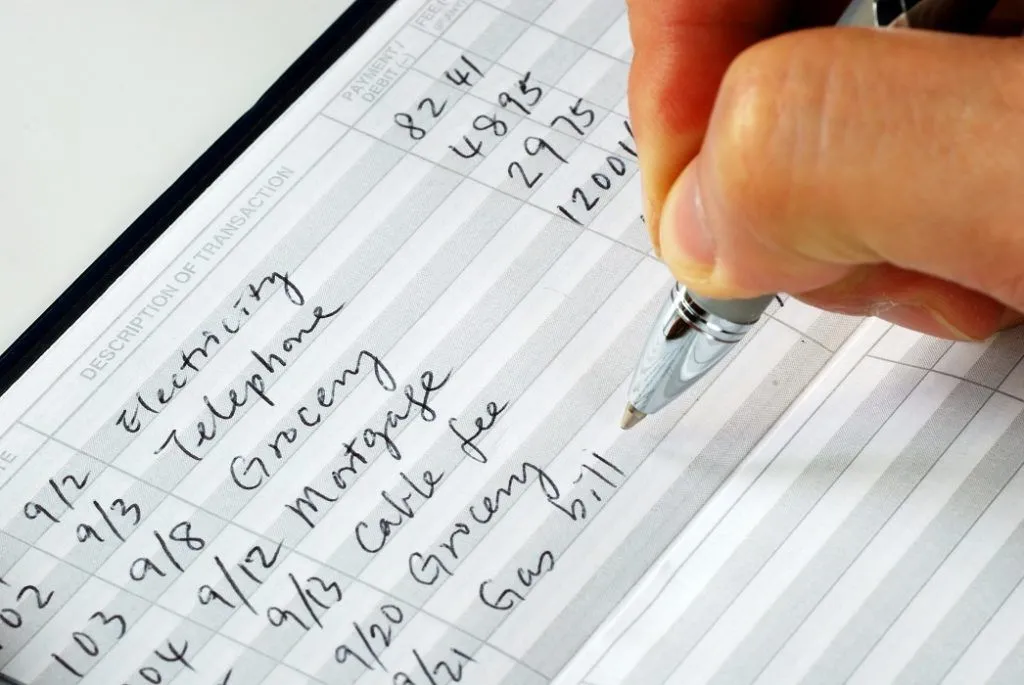

CHECK REGISTER

When you write checks you record them in your check register. It is inside your checkbook. You will also record when you use your debit card here, as well as any automatic payments that get made out of your checking account like automatic utility company payments.

RECORDING THE CHECK IN YOUR CHECK REGISTER

Now that you have written a check we need to record it in the check register. This is so you will always know how much money remains in your checking account.

You record the check number first…in this case it is 1008.

Write the date next . In this case it is July 1 2018

Write the person’s name you wrote the check to. Acme Grocery

Write the check amount in the column called PAYMENT AMOUNT

Subtract the amount of the check from the running balance number (the right most column) and record that resulting number in that space to show how much money is left after that check is cashed.

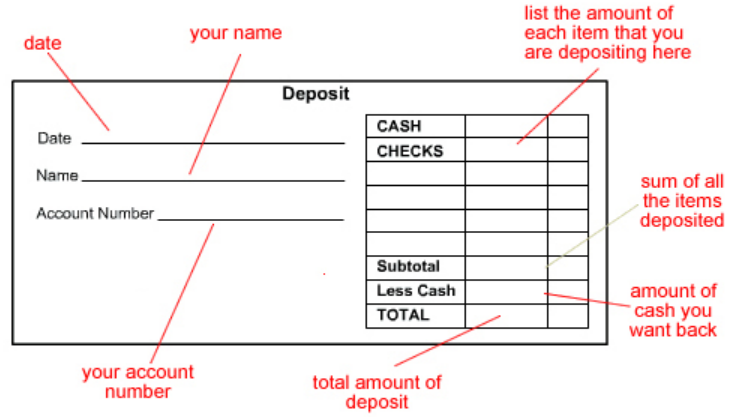

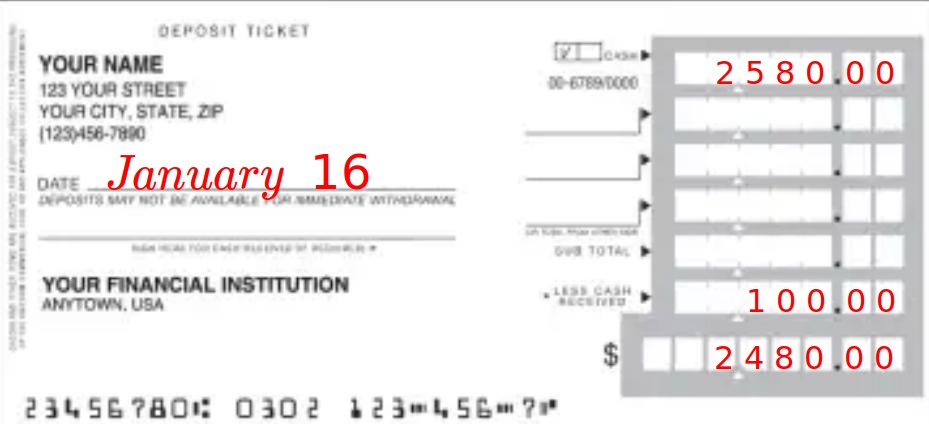

MAKING A DEPOSIT

This is a deposit slip. You use this whenever you go to the bank and make a deposit to your checking account. You will use one when you first open your checking account at the bank and put money into it.

Here is an example of one that was filled in when you started this checking account….

Every time you make a deposit you must make an entry into your check register. This is so you can balance you checkbook at the end of the month.

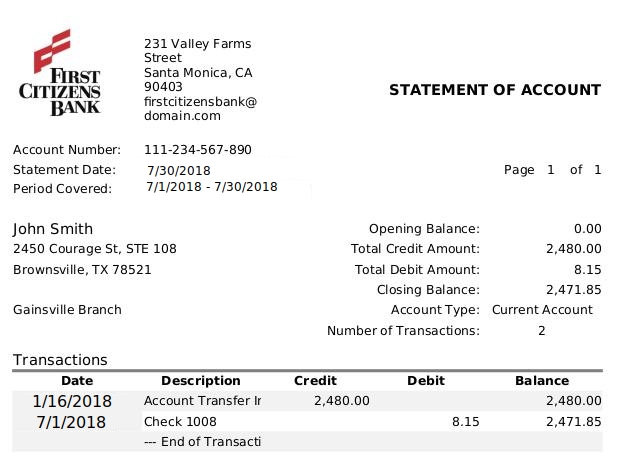

THE BANK STATEMENT

You will get a bank statement once a month. It will summarize all the transactions that the bank received against your account.

Some of the transactions from the month may not have shown up at the bank by the time the statement was printed. Because of this you need to balance your check book.

BALANCING YOUR CHECKBOOK

This is also called reconciling your checking account. It is a fairly straightforward formula.

Check Register balance

plus Deposits not on the Check Register

minus Checks not on the Check Register

= Bank statement balance

STEPS TO BALANCING YOUR CHECKBOOK

1. Verify all the checks have posted to the bank

At the beginning of the statement for each check in the statement you find in your register, put a check mark against that item in the register, and a check mark on the statements line item also.

2. Verify all the deposits have posted to the bank

At the beginning of the statement for each deposit in the statement you find in your register, put a check mark against that item in the register, and a check mark on the statements line item also.

3. Subtract any services charges or automated withdrawals

These will be the charges you DID NOT check-mark on the statement.

4. Check for any errors you made

If Things Don’t Add Up

- Take a short break to clear your head.

- Start by re-verifying your outstanding items.

- What’s the difference? Is your checkbook balance higher or lower than your statement? Subtract the smaller figure from the larger one to get the difference. Now…

- Divide the difference by 9. If 9 goes in evenly (that is, with nothing left over), the problem is transposed numbers. For example, $258 was recorded as $285. Look over your receipts and cancelled checks and double-check your amounts.

- Divide the difference by 2. If the answer you get is a “normal” dollars-and-cents amount (i.e., $7.19 rather than $15.125), look for that amount in your register—it was added instead of subtracted, or vice versa.